Selling Stocks at All-Time-Highs*

Jan 19, 2021

By Frank Kaberna

There’s something attractive about selling a new all-time high in a market. Maybe it’s the rush of pretending to be Spider-Man stepping in front of a runaway train rampaging through the Upper East Side. Or it could be the potential for glory if you sell the high print and scurry off like Charlie with a golden ticket. Most likely, though, it’s simply the opportunity to sell something that’s never been this expensive before.

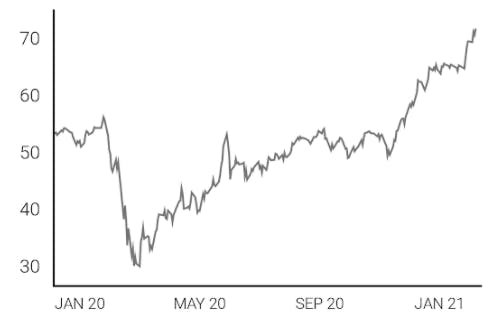

The runaway train that could be a seller’s golden ticket is the stock market (though Bitcoin is flexing similar locomotive features). Small Stocks (SM75) futures are up a shade under 10% in the first ten trading days of the year, and SM75 is only a few dollars away from its projected upside boundary for all of 2021. ** It’s not even February yet!

Wrong Way on a One-Way Track? (Small Stocks \ SM75)

Source: dxFeed Index Services

That said, equity markets and all their moving parts don’t reverse course overnight simply because they put in a new high the day before. As witnessed in recent years, all-time high prints in equity indices can stack up on each other for months. So how can you wait out the sunshine?

Getting small is essential for strategies that can require long periods of time. You can start out with a Small Stocks (SM75) future, which is approximately a third the size of the Micro E-mini S&P 500 future.

Wanna go extra small? Try attaching a short put or put spread to your short SM75 position by using options on highly correlated products like IWM and DIA.

There’s nothing wrong with pretending you’re Peter Parker, but don’t forget that Spider-Man needed to count on his superpowers to stop that train.

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.

*Highest price in SM75 stock index since inception

**One standard deviation projection using realized volatility taken on 12/31/20