The Anti-Outlier Trade

Apr 5, 2021

By Frank Kaberna

Most people like talking about a good outlier story: Can you believe bitcoin is up over 1,000% since the start of 2019? Did you see WTI crude oil futures went negative last year? How crazy was that rally in GameStop from below $20 to above $400 in a matter of weeks?

But trading an outlier isn’t as easy. Increased volatility means you could be either really right or really wrong in a flash. Large swings mean a move against you could cause you to tap out before a move in your favor. And few people feel good about buying into an all-time high, or vice versa.

The Case for Mean Reversion

You know what’s not as fun to talk about, but occurs much more often? A market that approaches an outlier but ends up reverting to what’s deemed “normal.” Last week was ripe with mean reversion trades including a bounce back in metals, the convergence between technology and industrial stocks, and a pull back for both US dollars and interest rates.

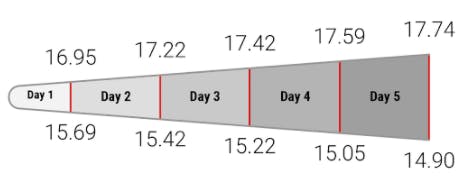

Last Week's Forecast via Realized Volatility (Small 10YR Yield \ S10Y)

Source: dxFeed Index Services

How to Trade Mean Reversion

For example, Small 10YR Yield futures rose above 17.50 by the second day of last week before falling back to well within their projected five-day range (as shown above) by the week’s close. Getting on the other side of a slightly abnormal move (relative to historical prices and volatility) in a market can present opportunity more often than the large outlier alternative.

Near-outliers aren’t going to make you more interesting at your next dinner party, but they could present you with a simpler, more straightforward opportunity the next time you open your platform.

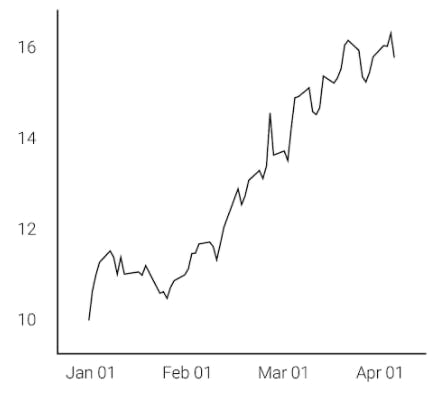

Small 10YR Yield \ S10Y

Get Weekly Commentary on Small Markets!

To learn more about trading the Smalls, sign up for our free weekly newsletter which covers everything from stocks and bonds to commodities and foreign exchange.